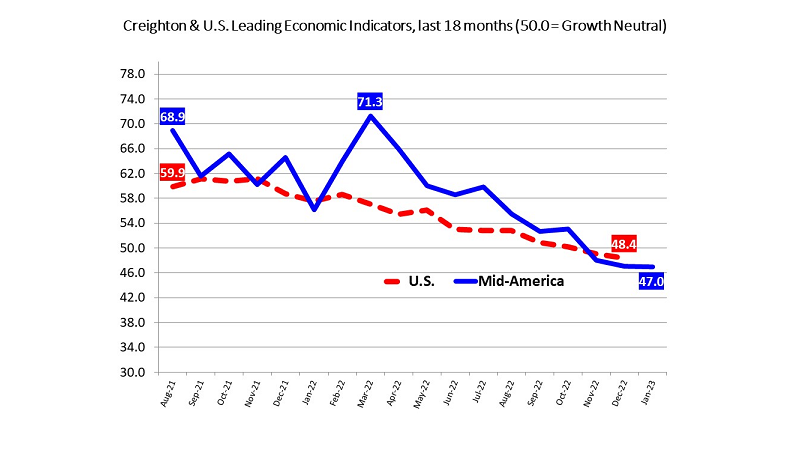

In his monthly Mid-America Business Conditions Index survey of supply managers, Creighton University Economics Professor Ernie Goss, PhD, says the economic index for January declined slightly to 47.0, which was below growth neutral and the lowest number since the pandemic in May 2020.

Goss said this also was the lowest January reading since the 2008 recession. “We asked about the threats to firms and businesses and what they judge as the top (threat). Supply chain disruptions were No. 1; higher input prices were No. 2; and recession, No. 3. What was surprising is that finding and hiring qualified workers and labor shortages were not in the top six. That was a surprise to me.”

Regardless, hiring fell below growth neutral in January. Goss expects unemployment and job losses to increase slightly in the weeks ahead. “Approximately 26% (of supply managers) reported workforce reductions. Instead of gaining, we’re reducing the size of the workforce in the region,” said Goss. “The overall region, compared to pre-COVID levels, were almost even. We’re down about 6,800 workers in the entire 9-state region from pre-COVID, that would be February of 2020, so still down from pre-COVID numbers.”

Goss says the average wage growth was 4.1%. However, when you adjust it for inflation, Goss says wages are down 2.2%. Regarding inflation, the index increased to 74.2 in January from 52.1 in December. “Keep an eye on the bond market, that will tell you where everything is moving. Particularly, keep an eye on the 10-year treasury. That rate has come down by 25 basis points over the last month, indicating that long-term investors expect inflation to be conquered by the Federal Reserve. I think the Federal Reserve will conquer inflation, moving it back down to 2%. It’s going to take a while, but the long-term inflation number will move back down to 2%. It probably will not be this year, though.”

Goss predicts the Federal Reserve to increase interest rates by a quarter of a percent. He expects economic growth to dip slightly into negative territory. “In other words, flat-lining for the next quarter and probably the second quarter, as well. Inflation for the month will decline. I think from January to February, we’re going to see 4% growth in inflationary pressures, and a 4% increase in the Consumer Price Index (CPI). I think that’s what will be reported by the Federal Reserve and the Bureau of Labor Statistics.”

Nebraska’s index: After four consecutive months of below growth neutral readings, Nebraska’s Business Conditions Index climbed above the growth neutral threshold. The overall reading in January increased to 55.7 from 49.9 in December. Components of the index from the monthly survey of supply managers for January were: new orders at 44.5, production or sales at 51.8, delivery lead time at 58.2, inventories at 54.2 and employment at 69.8. According to U.S. Bureau of Labor Statistics wage data, the state’s average inflation adjusted hourly wage rate fell by 2.7% in 2022.